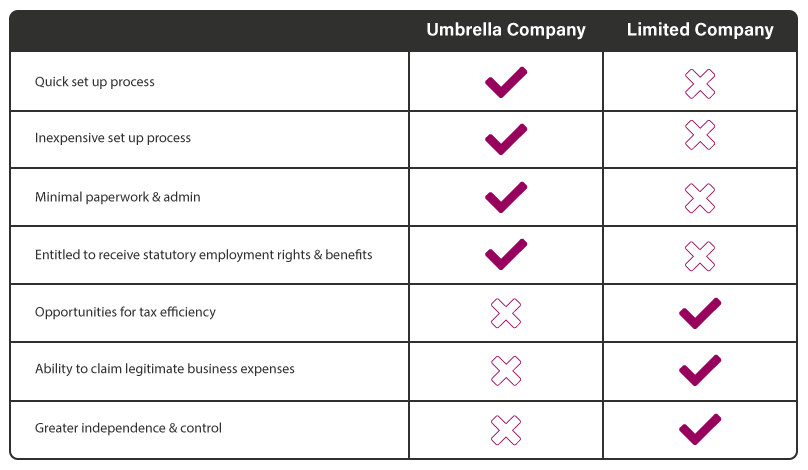

Comparing an Umbrella with a Limited Company

For professional contractors the choice of how to structure your finances normally falls between operating via an umbrella company and setting up your own limited company.

We can help with your decision. We have explored the advantages and disadvantages of each option and the key aspects you may need to consider in more detail.

Set up process & costs

Setting up a limited company may seem daunting. If you do this directly you will need to submit your documents online with Companies House. However, there are several important forms you will need to complete to set your company up and this can be time consuming. Post incorporation, you’ll need to register for Corporation Tax, PAYE and VAT if applicable.

As the process of setting up involves considerable paperwork and liaising with a number of organisations, many contractors find it easier and more convenient to use a specialist contractor accountant that understands the specific needs of their business. Such an accountant can provide the necessary expertise to make the process straightforward and relatively hassle-free. They will also provide ongoing support and advice for running a business, including assistance with annual accounts, Annual Returns & HMRC compliance. The cost of an accountant will vary depending on who you choose, but you will normally pay them a monthly fee and they will manage all your company’s tax affairs.

Similarly, the cost of joining an umbrella company is usually minimal, with many offering a free sign up service. There will, however, be a weekly or monthly fee (margin) charged by the umbrella company for administering your payroll. This will be deducted from your final payslip and should be clearly documented. Remember, fees charged by the umbrella company can be claimed back as legitimate business expenses so you won’t pay any additional tax on these fees.

Joining an umbrella company can take as little as 24 hours and incorporating your company can be equally as quick (so long as you have all the required documentation completed correctly). Registration for taxes (VAT, Corporation Tax) for your limited company and setting up a separate bank account can however take a few weeks.

Paperwork & admin for contractors

As an independent contractor you will have more personal paperwork and administration requirements to complete at the end of every month compared to your permanent counterparts. This will be particularly apparent for limited company contractors who are also responsible for running and maintaining their company both from a financial and legal standpoint. The paperwork involved in running your company will include invoicing, submission of Annual Returns, completing and filing Annual Accounts, Self-Assessment tax return (as a director) and paying Corporation Tax.

The benefit of using an umbrella company is that all of the paperwork involved in administering your contracts is part of their payroll service. This means the umbrella company will process all your timesheets and invoices, calculate your taxes, allow for any deductions and pay you (as the employee) a salary.

Tax efficiency & returns

Forming a limited company to invoice through is fairly common practice for contractors and while there are many advantages to doing this, one of the main attractions is the scope for better tax efficiency and a higher percentage return from your contract earnings.

Using a combination of a low salary and dividends to pay yourself means you pay less in National Insurance contributions. You also have the ability to claim a wider range of tax-free business expenses and have the option to register for flat rate VAT. All of these possibilities give you more opportunity to hold on to your hard earned cash.

By contrast, invoicing through an umbrella company can be seen as the more expensive way of working. You will receive a salary that is subject to full PAYE Tax and NI and there are fewer methods available for making the structure more tax efficient.

Independence, status & control

Whilst the type of work you do, the outcome of your contracts and the way you conduct your business may be the same regardless of the payment structure you choose, limited companies are typically held in higher regard and are often seen as a more credible and trustworthy set up.

This is because a limited company is treated as a separate legal entity or a legal ‘person’ in its own right. So, if anything was to go wrong, any debt, losses or legal claims are the responsibility of the company not the individual contractor. This limited liability is crucial if you plan to provide high-value supplies or services. Being held in higher regard also makes the limited company option an ideal set up for longer term professional contractors. However there are changes on the horizon with Off Payroll rules coming into force in the Private Sector from April 2021. This in effect takes the control from you deciding if you are inside or outside of IR35 and placing it firmly with the end client.

Umbrella company contractors are employees and are consequently reliant on their umbrella provider to collect their money from the recruitment agency and arrange their payments, tax and national insurance contributions. The positive aspect of this is that the umbrella company will take away much of the contractor’s administration, giving them more time to concentrate on their assignments and life outside contracting.

Compare Umbrella with Limited Company

Why do contractors use umbrella companies?

Umbrella companies are principally responsible for organising payment for your work. However there are a number of additional advantages that make them such an attractive option, particularly for time-pressed contractors.

Making life simpler and easier

Umbrella companies offer contractors a simple and straightforward means of receiving their pay. As well as streamlining administration, tax and National Insurance payments, other benefits for contractors include:

- Fast and simple set up. Start billing and start contracting in less than 24 hours

- Ability to carry out a number of temporary contracts but receive one convenient payslip each month or week

- They can offset allowable expenses against their tax liabilities

- No unplanned tax bills relating to their timesheets at the end of the year with accurate calculations and payments made on their behalf

- No director duties or legal company requirements to adhere to

- Access to many statutory benefits typically associated with being in permanent employment such as, sick pay, holiday pay and maternity pay

- No need to worry about IR35 and SDC regulations – the contractor is already taxed as an ’employee’ so these rules do not apply

Ask us a question, find out your options, make your contracting easier.