Understanding your PAYE options

Being a contractor gives you a range of trading options including the familiar option the traditional employee PAYE system. This option can help you save a considerable amount of time when you start contracting because much of the administration in terms of payroll is handled on your behalf.

If the way you work and the contract you are working under falls within IR35, it can be the only option available to you. Those new to contracting and not yet familiar with the responsibilities involved in running their own limited company may see it as a more convenient and user-friendly option. However, if you are considering the PAYE route, it is important to realise that there are two very different versions: PAYE via a recruitment company or PAYE via an umbrella company.

Is Umbrella PAYE the same as Agency PAYE?

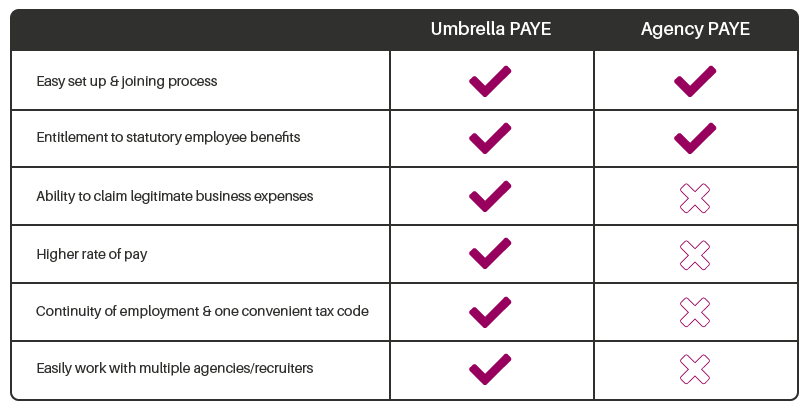

Both umbrella and agency PAYE involve the contractor becoming an employee and with payroll processed on their behalf. This means that if you are an employee you don’t need to worry about taxes, complying with IR35 or keeping detailed business accounts. However, there are some key differences to be aware of. Here we look at the differences between umbrella PAYE and agency PAYE in more detail.

Set up and joining

Both the umbrella and agency PAYE options are easy to set up which means you can join either payroll solution in a matter of minutes. You will provide the company with your details via an application form together with proof that you can work in the UK. In many cases this can be done online. The umbrella or agency involved will typically need the following supporting documentation:

- Certified ID

- Proof of residence

- Banking details so you can receive your payments

- National Insurance Number

The only additional step for umbrella company employees is to provide the recruitment agency with the umbrella company details.

Employee benefits

Both agency and umbrella company contractors are employed by the relevant company so they should have access to certain statutory benefits that are available to permanent employees, including holiday, sickness and maternity/ paternity pay.

Tax simplification

If you join an umbrella payroll you receive income for all of your assignments using your personal allowance and regular tax code, regardless of the number of recruitment agencies you use to find work. This gives contractors much more flexibility and the convenience of having one pay day, one tax code and one P60. This simplifies your tax affairs and makes it far easier to prove your income should you need to apply for a mortgage or other form of lending.

Costs

If you choose to operate through an umbrella company then a fee will be taken for the services they provide. The amount should be modest and prove to be value for money given all the administration and paperwork assistance they provide. Remember, if you’re not happy with your provider or you decide to change the way you work, you are always free (subject to any notice period) to switch to another company and find a better deal elsewhere.

Normally there is no direct cost to working through an agency PAYE, However your agency should uplift your contracted rate if you opt for the umbrella route. This is to cover employment costs (such as Employer’s NI) and also account for the umbrella company’s margin.

Compare Umbrella with Agency PAYE

Why do contractors use umbrella companies?

Umbrella companies are principally responsible for organising payment for your work. However there are a number of additional advantages that make them such an attractive option, particularly for time-pressed contractors.

Making life simpler and easier

Umbrella companies offer contractors a simple and straightforward means of receiving their pay. As well as streamlining administration, tax and National Insurance payments, other benefits for contractors include:

- Fast and simple set up. Start billing and start contracting in less than 24 hours

- Ability to carry out a number of temporary contracts but receive one convenient payslip each month or week

- They can offset allowable expenses against their tax liabilities

- No unplanned tax bills relating to their timesheets at the end of the year with accurate calculations and payments made on their behalf

- No director duties or legal company requirements to adhere to

- Access to many statutory benefits typically associated with being in permanent employment such as, sick pay, holiday pay and maternity pay

- No need to worry about IR35 and SDC regulations – the contractor is already taxed as an ’employee’ so these rules do not apply

Ask us a question, find out your options, make your contracting easier.